As of the end of 2023, the number of licensed financial leasing companies by the PCMA reached eight companies. Additionally, one company is working to rectify its situation to complete the renewal of its license, while a new independent company has applied to engage in Islamic Sharia-compliant leasing activity, with its application currently under review. The licensed companies are:

|

|

Company |

Conventional or Sharia-compliant Financial Leasing |

|

1 |

Palestinian Leasing & Leasing Company – Palis |

Conventional Financial Leasing |

|

2 |

Palestine Leasing Company |

Sharia-compliant Financial Leasing |

|

3 |

Ritz Leasing Company |

Conventional Financial Leasing |

|

4 |

Lease For You Company |

Conventional Financial Leasing |

|

5 |

Lease & Go |

Conventional Financial Leasing |

|

6 |

Gedico Leasing Company |

Conventional Financial Leasing |

|

7 |

Integrated Leasing Company |

Conventional Financial Leasing |

|

8 |

Arabian Leasing Co. |

Conventional Financial Leasing |

The PCMA issued Instructions No. (1) of 2023 amending Instructions No. (1) of 2016 regarding the licensing of financial leasing companies on April 12, 2023. The aim of issuing these instructions is to implement the provisions of Law No. (6) of 2014 regarding financial leasing, stipulating that the primary activity of financial leasing companies is to engage in leasing activities. Therefore, the instructions prohibit financial leasing companies from owning real estate except to the extent necessary for their operations, except for real estate subject to leasing contracts. The same applies regarding ownership of securities or participation in other companies, where it should serve the company’s purposes in conducting its primary activity.

New regulatory financial standards have been introduced to regulate the relationship between loans obtained by companies and the leasing portfolio of the company. The balance of loans from various financing entities should not exceed 120% of the net investment balance in financial leasing. This introduces a new approach to risk-based capital, where companies, to stay within this ratio, must increase their capital. Additionally, there is a financial index related to loans and financing granted by companies to other parties, unrelated to leasing contracts, which should not exceed 5% of the paid capital of the financial leasing company. The financial leasing company must have employed the required capital under the instructions in financial leasing activity fully before that.

The instructions grant companies a one-year period to rectify their situations, with the possibility of extending the period for an additional year with the administration’s approval.

The consulting company has completed the legal study of the regulations in the financial leasing sector. Several meetings were held with the PCMA and financial leasing companies to present the topics researched, the research methodology used in the study, the conclusions drawn, and the recommendations made.

The study reviewed the legal framework governing the sector, compared international experiences, examined sub-leasing, the registration of immovable properties leased financially, Sharia-compliant financial leasing activities, financial leasing in banks, the impact of current legislation on financial leasing activities, and the registration of financial leasing contracts with the PCMA. Additionally, it provided proposals for amendments to existing legislation and suggestions for drafts of additional legislation.

The PCMA will review and approve these proposals to achieve the goal of completing the regulatory framework for the financial leasing sector and to continue developing this sector.

Aggression on the Gaza Strip:

All economic sectors were affected, both directly and indirectly, by the aggressive assault on the Gaza Strip. The impact on the financial leasing sector was indirect, as financing is concentrated in the northern governorates rather than the southern ones. This is due to the non-implementation of the financial leasing law by decree in the southern governorates as a result of the division. Financial leasing companies are facing difficulties in collecting due payments from lessees. This is due to the loss of employment for workers inside the green line immediately after the assault began, the salary crisis affecting public sector employees, and the loss of jobs for private sector employees due to the general economic downturn, as well as the financial crises faced by small and medium-sized enterprises.

Regarding new financings, the demand for financing from individuals and companies has decreased due to the prevailing general atmosphere and the state of uncertainty in the country, which has negatively impacted various economic indicators such as consumption and investment. Financial leasing companies have become more cautious in their lending operations for two reasons: The decrease in funding sources for financial leasing companies, which are predominantly banks. Banks have become more conservative given the current political and economic conditions in the country, and concerns about the ability of new lessees to make payments, leading to potential defaults under the prevailing circumstances.

Sector Statistics

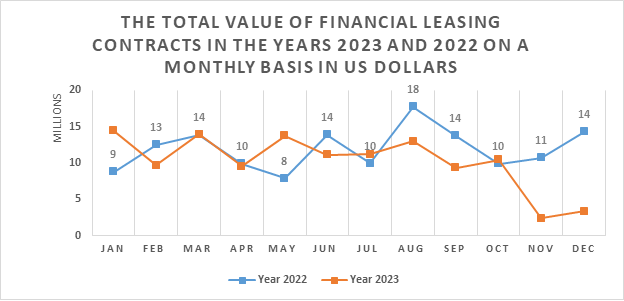

The total investment in financial leasing contracts registered with the PCMA at the end of the year amounted to approximately 122 million US dollars, with 2431 contracts. The statistics for 2023 represent a decrease in the value of contracts by 14.5% compared to 2022, and by 13% in terms of the number of contracts. This decrease is due to the repercussions of the aggression on the Gaza Strip. This has negatively affected the business of financial leasing companies operating in this sector. The graphs show the monthly growth in financial leasing contracts in value and number between 2022 and 2023.

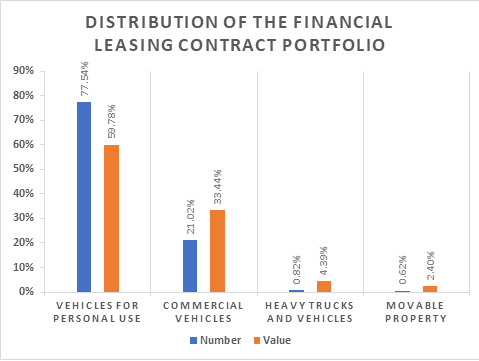

As for the distribution of the financial leasing contract portfolio in 2023, according to the type of assets and the purpose of use, we believe that vehicles for personal use are the most financed assets, as the value of contracts reached (59.78%) of the total value of contracts, and (77.54%) of the number of contracts.

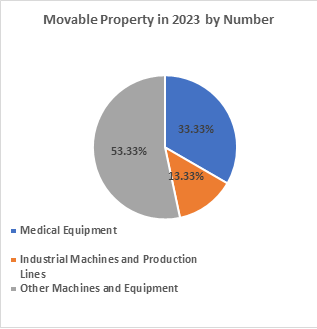

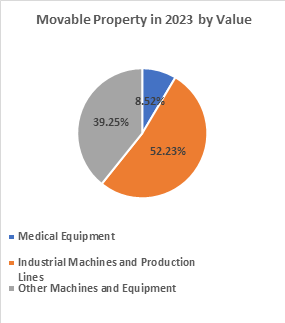

We also provide you with a graph below that reflects the distribution of the category of movable assets – movable property (machinery, equipment, production lines – etc.) in terms of the type of assets value and number, which constituted 2.40% of the value of contracts and 0.62% of the number of registered contracts, as the reclassification of financial leasing contracts on the PCMA’s electronic system enabled us to classify these assets according to their type, and to know the share of each of them in the movable property portfolio, as follows:

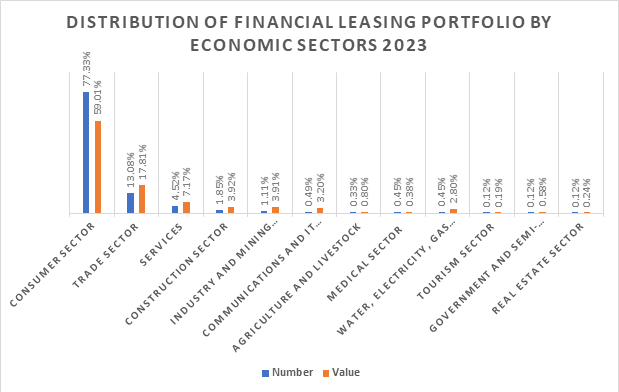

As for the share of each economic sector of financial leasing, the graph shows the share of each sector of contracts in value and number. We believe that the consumer sector is the most benefited sector, as the percentage of the value of contracts reached (59.01%) of the total value of contracts, and (77.33%) of the number of contracts, and these contracts represent financing vehicles for personal use, and this is compatible with the economic pattern in which we live, as it is an economy based on consumption.

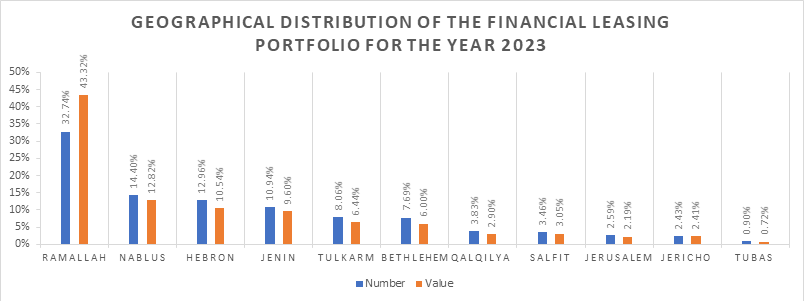

With regard to the geographical distribution of the contract portfolio, Ramallah and Al-Bireh governorate accounts for the largest share of the portfolio with 43% in terms of value, and 32% in terms of numbers, followed by Nablus governorate and Hebron governorate. This distribution is compatible with the structure of the economy and the concentration of business in the governorates.

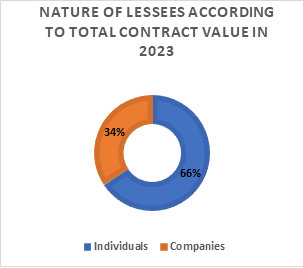

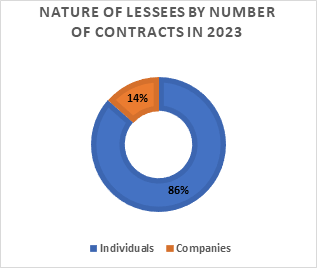

In terms of the nature of lessees, whether as an individual or a company, the percentage of individual lessees reached 66% of the value of the contracts, and 86% of the numbers, as shown in the following graphs: