- Issuing Directives for licensing electronic platforms and related decisions

Within the framework of the PCMA’s endeavor to promote the use of financial technology in the non-banking financial sectors to create an encouraging and friendly environment for innovations and solutions based on financial technology, and based on the monitory and supervisory role the PCMA plays in enhancing the possible regulatory environment for the use of financial technology in the non-banking financial sectors, the PCMA issued Directives No. (2) of 2022 relating to “licensing of electronic platforms for the sale or the provision of services relating to collection and comparison of non-banking financial services,” and Decision No. (1) of 2022 was issued regarding “technological controls and rules for securing and protecting information relating to the provision of non-bank financial services via electronic platforms” which Decision was issued in accordance with the Instructions, in addition to the issuance of Decision No. (3) of 2022 regarding “the issuance of insurance contracts electronically through insurance companies third-parties’ electronic platforms.”

- Working on developing the regulatory framework necessary for the work of the experimental control environment (Regulatory Sandbox) to accommodate and encourage financial innovations.

The PCMA seeks to complete its strategic goal of employing financial technology in the sectors it supervises. In this context, during the year 2022, the PCMA paved the way towards the launching of the experimental control environment, which is considered as an experimental environment that allows developers of innovative non-bank financial technology services to experiment applications of innovative financial technology in reality, and on real customers, which, currently, the developers of financial technology services are unable to provide in the Palestinian market , either due to the existence of regulatory obstacles or the absence of regulatory rules regulating it. The experimental control environment enables emerging companies in the field of modern financial technologies to work within the framework of an experimental environment, and provide their services to a limited number of consumers, which helps the gradual maturation of the business models of these companies. The experimental regulatory environment aims to reduce the cost of innovation in some cases, and to give room for the entry of regulatory authorities, which provides a safe and formal framework for direct testing and market monitoring, which is considered an indication of regulators’ openness to innovations, by testing the innovation in a live market on the basis of both the time and scope specified to reach the appropriate regulatory status before the innovation can fully operate in the market.

- “EBTAKER” platform

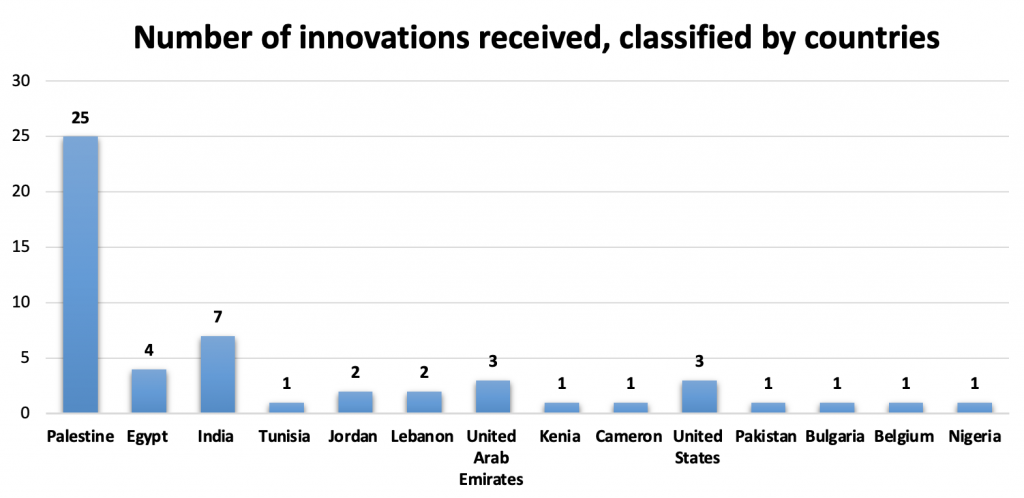

Two years after the launching of the EBTAKER platform, the number of innovations received through the platform reached 53, out of which 40 innovations were received during the year 2022.

At the beginning of 2022, and after receiving many innovations and ideas relating to the non-banking financial sector, it was noted that there were no applications capable of addressing the existing challenges in the insurance sector, or ready to meet the urgent needs of the sector. From this standpoint, the PCMA worked to develop and launch the Insurtech Wizard, a regional competition that expanded the scope of attracting entrepreneurs and innovators in the surrounding countries, especially Palestinian entrepreneurs in the diaspora. It also aimed to receive specific solutions and applications that contribute to addressing the existing challenges that the Palestinian insurance sector suffers from. The competition was divided into two tracks:

- The first track: Insurtech hackathon, targeting people with creative ideas in the field of insurance technology.

- The second track: the Innovation Challenge, targeting emerging and existing companies of different sizes, whether local or international, that have solutions and applications under implementation, or ready to be applied in the field of insurance technology.

This competition has contributed to introducing the Authority’s role in promoting financial technology, specifically the “EBTAKER” platform, as well as highlighting the Palestinian insurance sector at the regional and international levels, whereby 35 applications for participation in the competition were received, and they were processed according to the terms of the competition, through the various arbitration committees that were appointed in context of the competition. The winners of both tracks are expected to be announced during January of next year.

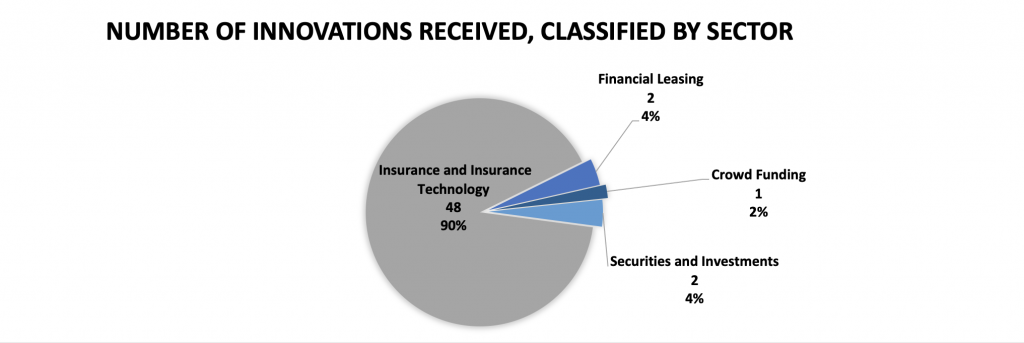

Thus, the number of applications processed through the “EBTAKER” platform in the year 2022 reached 40 innovations, with different categories of applications sent, whether they are individuals or companies, or through the platform directly, or those received through the competition. These innovations were directed to suit the PCMA’s policy and the need of the non-banking financial sector in Palestine, by providing (non-binding) follow-up and guidance thereto, and some of them were given a non-objection letter and others have extended the non-objection letter granted, such as the Middle East Initiative Company/Tamweely Application, which works to provide networking and awareness services in the insurance sector. It is worth noting that the insurance sector occupied the largest percentage of the number of innovations presented to the platform, followed by innovations relating to the financial leasing and securities sectors.

In this context, during the year 2022, strenuous efforts were made to update and develop the “EBTAKER” platform with relevant guidelines and models, and international experiences were taken into account in this regard, to include the regional scope of attracting creative financial and technological ideas from outside Palestine, for the purpose of bringing and investing in them within the Palestinian financial sector. In addition, during 2022, a number of introductory and awareness-raising workshops were held on the “EBTAKER” platform in a number of universities, and meetings were organized targeting Palestinian business accelerators.

- Providing the appropriate environment for the development of innovative financial products

Stimulating crowdfunding services: In the context of providing an appropriate environment for the development of innovative financial products, the PCMA began preparing the legal framework regulating the work of crowdfunding funds. The German Corporation for International Cooperation (GIZ) prepared a legal diagnostic study aiming to a preliminary review of the existing legal framework, in addition to the available options before the regulatory bodies and the international and Arab experiences in the control and supervision of crowdfunding funds.

- Holding awareness activities to promote financial technology in the non-banking financial sector:

- A round table meeting was held in March 2022 entitled “The Role of Business Incubators and Accelerators in Promoting Financial Technology in the Non-Banking Financial Sector”, with the participation of a number of Palestinian and Arab incubators. During the meeting, the PCMA’s readiness for cooperation and partnership with business incubators and accelerators was emphasized, leading to the establishment of mechanisms that regulate the relationship between the two parties, endeavoring to sign agreements contributing to the growth of the non-banking financial sector, in addition to highlighting the local Palestinian economy, emerging companies and businessmen to take advantage of this opportunity and investment in the financial technology sector. It is worth mentioning that the meeting was done in coordination and cooperation with GIZ.

- A dialogue discussion entitled “Opportunities to use technology in the insurance sector” was organized in partnership with the Ministry of Entrepreneurship and Empowerment and the Union of Insurance Companies, supported by the German Corporation for International Cooperation (GIZ). This event came as a result of the implementation of the PCMA’s strategy aimed at developing the insurance sector, employing financial technology, keeping abreast of developments in this context, and improving and expanding the reality of insurance services to serve all customers, especially citizens, and facilitate their access to these services.