The number of financial leasing companies licensed by the Palestine Capital Market Authority, as at the end of 2021, reached nine, as the license of one company was canceled due to its inability to rectify its status in compliance with the provisions of the legislation in force at the PCMA.

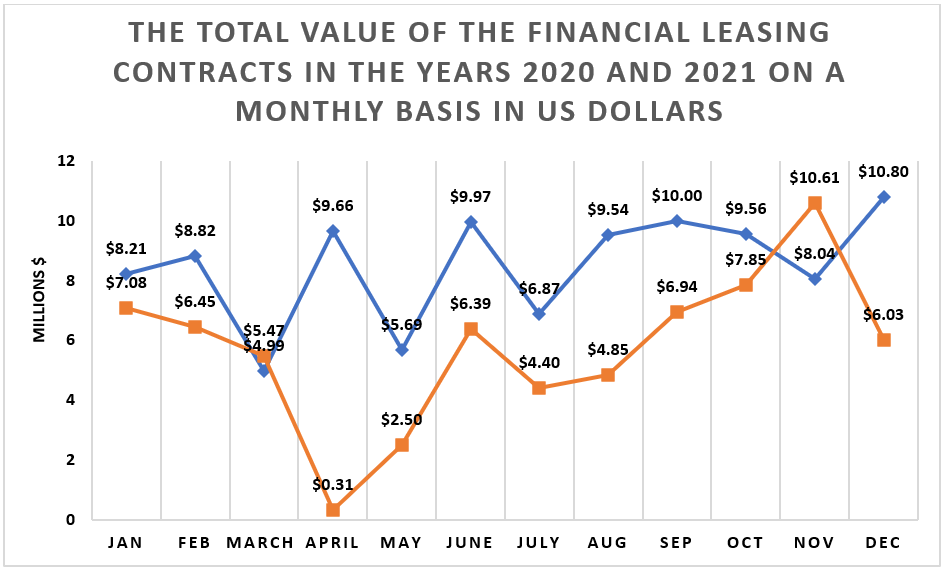

As of the end of 2021, the total investment value of financial leasing contracts registered with the PCMA amounted to 102 million US Dollars, with 1,900 contracts. This represents an increase in the value of contracts by 48% compared to 2020, and by 39% in the number of contracts compared to the previous year. The rise is due to the gradual recovery of the Palestinian economy in light of the breaking of the epidemic curve of the Covid-19 pandemic, which was positively reflected on the performance of the financial leasing sector, which witnessed a remarkable growth in the portfolios of financial leasing companies to pre-pandemic levels.

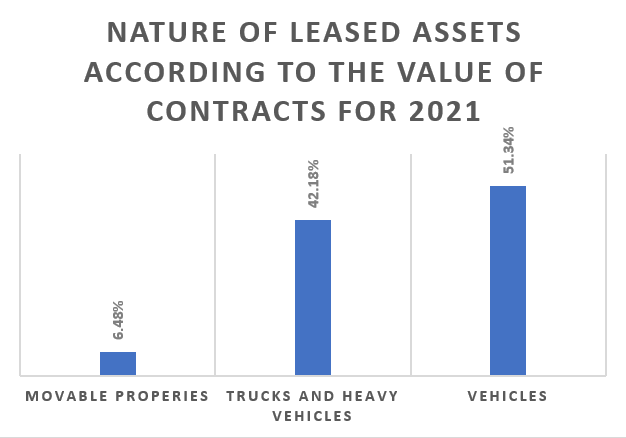

At the end of 2021, vehicles for personal use accounted for 51.34% of the total value of contracts, while vehicles for commercial purposes constituted 42.18%, and the share of money transferred from the portfolio amounted to 6.48%, down from 8.02% last year, but it is worth noting that the total value and number of portfolio contracts for the year 2021 is greater compared to 2020. The diagram below shows the distribution of the types of leased assets in the financial leasing portfolio in 2021 according to the total value of contracts:

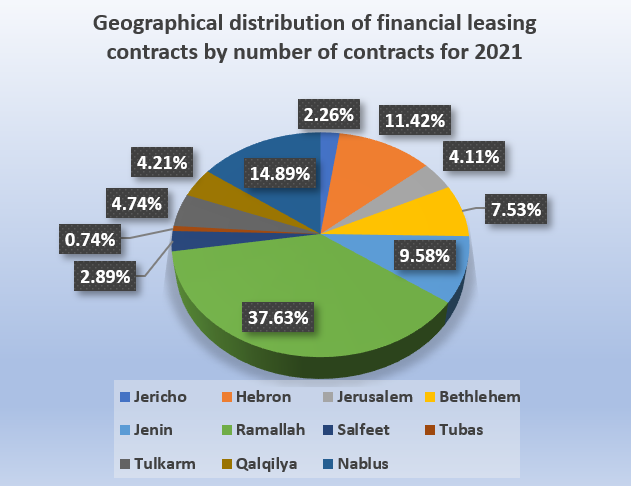

As can be noted from the diagram below, the governorate of Ramallah and Al-Bireh still ranks first, witnessing a high concentration in the number of financial leasing contracts with 37.63%, followed by Nablus with 14.89%, then Hebron with 11.42%, and the rest of the cities together constitute a total of 36.06% of the total number of contracts.

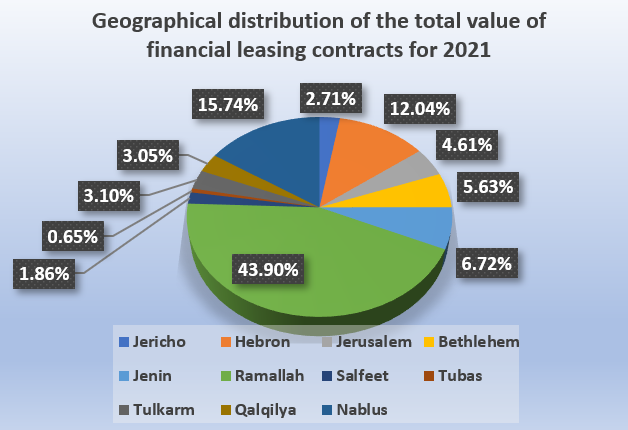

In terms of geographical concentration of the total value of contracts, the largest concentration was in Ramallah and Al-Bireh governorate with 43.86%, followed by Nablus and Hebron governorates with 15.75% and 12.04% respectively, and the rest of the governorates constituted 28.3% of the total value of contracts.

The diagram below shows the geographical distribution of the total value of financial lease contracts for 2021.

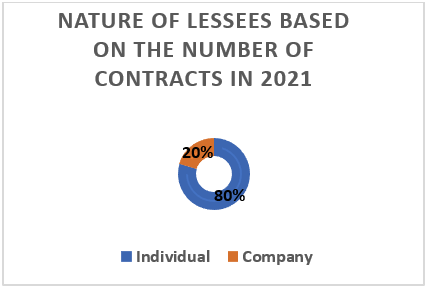

As for the nature of the tenants in relation to the number and total value of the financial lease contracts registered in 2020, they are shown in the following diagram:

As is clear above, 80% of the number of registered contracts belong to individuals, with a value of up to 54% of the total contract value.